FHA Insured Multifamily Mortgages have been added to CMD-MD

With the help of two datasets from HUD I am able to create some time series on FHA insured multifamily mortgages. This dataset compliments my FHA and VA single-family data collection efforts to give a more complete picture of the Federal Government's support for housing. Although the detail on FHA insured multifamily mortgages is substantially greater than what I have for single-family residential market.

The new series cover the standard gambit for sectors of the capital markets: everything from gross endorsements, the prepayment rate, average maturity, current mortgage rate and mortgage rate on outstanding debt to create a refi incentive. The total number of housing units insured gives an estimate of government support towards housing the fraction of the low-income population. My estimate comes out at about 2% of the population.

The amount of new mortgage debt per unit gives an estimate of the housing costs (to build, refinance, or purchase a low-income status multi-family property). The database also includes "bad exits" which are terminations of FHA insurance for precarious reasons. What the data reveal is that this market performed well through the great recession largely because it's bubble burst 5 years before the recession began. In this respect, It was a harbinger of things to come.

I have also created a theoretical mortgage debt series which is the mortgage debt that would be outstanding absent the prepayment option. One can compare this series with the actual mortgage debt outstanding to get a sense of the total amount of interest savings afforded to borrowers. The total amount of interest savings has reached over 5% of GDP.

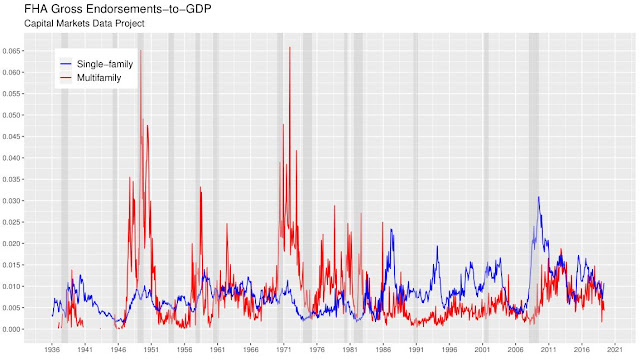

As can be from the chart below the multifamily market is part of the rich history of the government's program to support housing. Although the single family market is 10x larger. (In the figure Multifamily endorsements have been multiplied by 10).

This data begins in the late 1930's and is included in CMD-MD. CMD-MD is now available for purchase at the database level or at the individual series level. Email me at sabol.steven@gmail.com to enquire about pricing.

The new series cover the standard gambit for sectors of the capital markets: everything from gross endorsements, the prepayment rate, average maturity, current mortgage rate and mortgage rate on outstanding debt to create a refi incentive. The total number of housing units insured gives an estimate of government support towards housing the fraction of the low-income population. My estimate comes out at about 2% of the population.

The amount of new mortgage debt per unit gives an estimate of the housing costs (to build, refinance, or purchase a low-income status multi-family property). The database also includes "bad exits" which are terminations of FHA insurance for precarious reasons. What the data reveal is that this market performed well through the great recession largely because it's bubble burst 5 years before the recession began. In this respect, It was a harbinger of things to come.

I have also created a theoretical mortgage debt series which is the mortgage debt that would be outstanding absent the prepayment option. One can compare this series with the actual mortgage debt outstanding to get a sense of the total amount of interest savings afforded to borrowers. The total amount of interest savings has reached over 5% of GDP.

As can be from the chart below the multifamily market is part of the rich history of the government's program to support housing. Although the single family market is 10x larger. (In the figure Multifamily endorsements have been multiplied by 10).

This data begins in the late 1930's and is included in CMD-MD. CMD-MD is now available for purchase at the database level or at the individual series level. Email me at sabol.steven@gmail.com to enquire about pricing.