The Google search based mortgage refi index

Back in 2013 I was using Google Correlate to show some economists at the Richmond Fed what could be done using google search trends. Google Correlate is no longer supported by Google as it is too powerful a tool to be free. Luckily, I have saved search results and am able to create a mortgage refinance index. Now I know this is popular thing to do now, and that some firms offer this service to their clientele. I am not trying to undercut these firms, but I did this back in 2013 so I think that gives me the right to go ahead and take this liberty. I also had access to the MBA Refi Index back in 2013 to generate these correlations, hopefully MBA won't get pissed at me for circumventing the need to be a member or data subscriber.

Below is my mortgage refi index spliced with the MBA refi index.

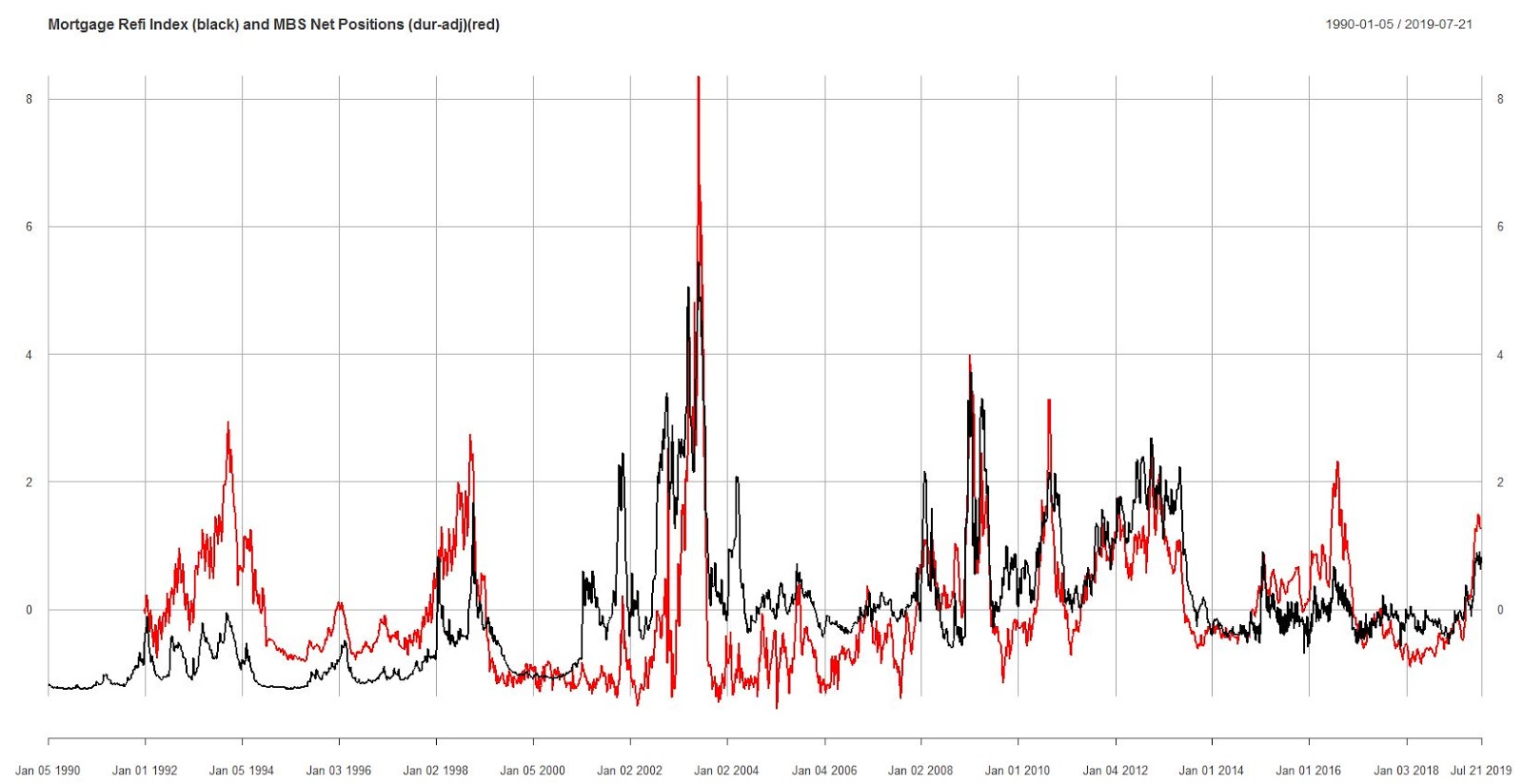

The next plot compares this index with primary dealer net positions divided by mortgage duration. This shows that refi risk is a real risk for primary dealers.

Below is my mortgage refi index spliced with the MBA refi index.

The next plot compares this index with primary dealer net positions divided by mortgage duration. This shows that refi risk is a real risk for primary dealers.